Technology

White-Label E-Wallet Development in Singapore

Jan 13, 2026

|

7

min read

As Singapore’s fintech ecosystem continues to mature, digital wallets and super-apps have become foundational infrastructure rather than optional innovation. Enterprises, fintechs, and digital-first platforms increasingly seek branded e-wallet solutions that give them control over customer experience, data, and monetisation.

Agmo Singapore delivers end-to-end white-label e-wallet development, enabling organisations to launch secure, scalable, and compliant digital wallet platforms without starting from scratch.

Why Build Your Own E-Wallet App

Third-party wallets solve payment acceptance. They do not solve customer ownership.

A proprietary e-wallet allows fintechs and enterprises to:

Own first-party transaction and behavioural data

Embed loyalty, rewards, and incentives directly into the payment flow

Reduce reliance on external platforms and intermediaries

Create closed-loop ecosystems for repeat usage

Expand into adjacent services such as BNPL, vouchers, subscriptions, or micro-financing

Fintech Use Cases We Support

Agmo’s e-wallet architecture is designed to support a wide range of fintech and enterprise scenarios, including:

Consumer & Lifestyle Wallets

Digital payments (QR, cards, in-app)

Loyalty points and rewards

Vouchers, promotions, and cashback

Merchant discovery and offers

Enterprise & Platform Wallets

Closed-loop wallets for platforms and ecosystems

Wallets embedded within super-apps

Corporate spending and internal credit systems

Subscription and recurring payment flows

Financial Services Enablement

Stored-value wallets

Transaction histories and analytics

KYC-ready user onboarding

Integration with regulated payment infrastructure

These use cases mirror successful wallet implementations across Southeast Asia and are fully adaptable to Singapore’s regulatory and market requirements.

White-Label E-Wallet Development, Done Right

Agmo Singapore provides white-label e-wallet solutions that can be customised to your brand, user experience, and business logic.

Our approach includes:

Mobile-first architecture (iOS, Android, cross-platform)

Secure backend systems with scalable APIs

Modular wallet components to accelerate time-to-market

Integration-ready design for payment rails and partners

Enterprise-grade security and governance

Compliance-Ready, Without the Headache

Singapore’s fintech environment demands high standards in governance, security, and compliance. Agmo Singapore works closely with regulated partners and infrastructure providers to ensure your wallet solution is:

Designed with regulatory requirements in mind

Architected for secure transaction handling

Ready for integration with compliant payment and e-money partners

Built with auditability and operational resilience

We focus on engineering and product delivery, while enabling you to align with regulatory obligations efficiently.

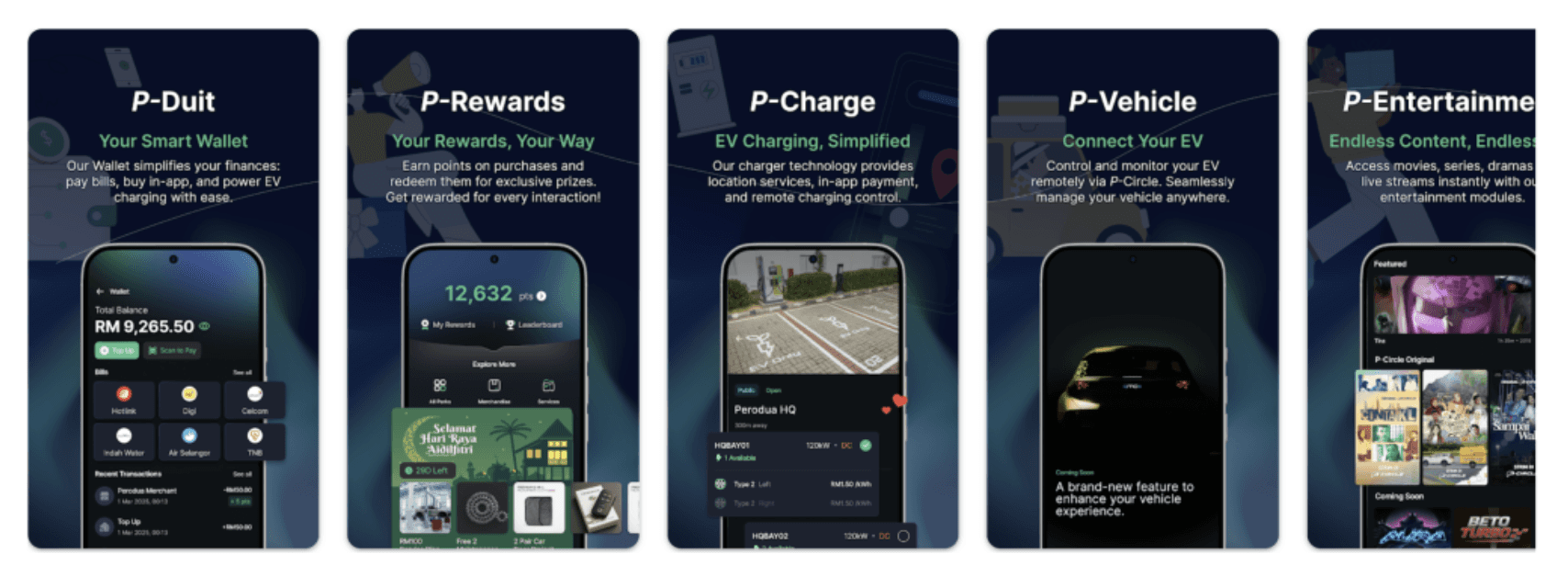

Case Study: Petronas P Circle

P Circle is a next-generation mobility and lifestyle superapp that brings payments, rewards, and digital services into a single ecosystem, anchored by its own e-wallet.

This case study illustrates how a large consumer brand can evolve beyond a traditional loyalty app into a full superapp strategy, with the e-wallet as the central enabler.

Key highlights:

P-Duit e-wallet enabling seamless payments, with a strong focus on EV charging and mobility-related transactions.

Mobility-as-a-Service (MaaS) capabilities, including EV charging locations, services, and remote vehicle-related features.

Lifestyle ecosystem integration, combining entertainment content and digital services within one unified app experience.

P Circle demonstrates how an e-wallet can act as the transactional backbone for mobility, lifestyle, and service platforms, a model increasingly relevant for superapps, transport-adjacent platforms, and consumer ecosystems in Singapore.

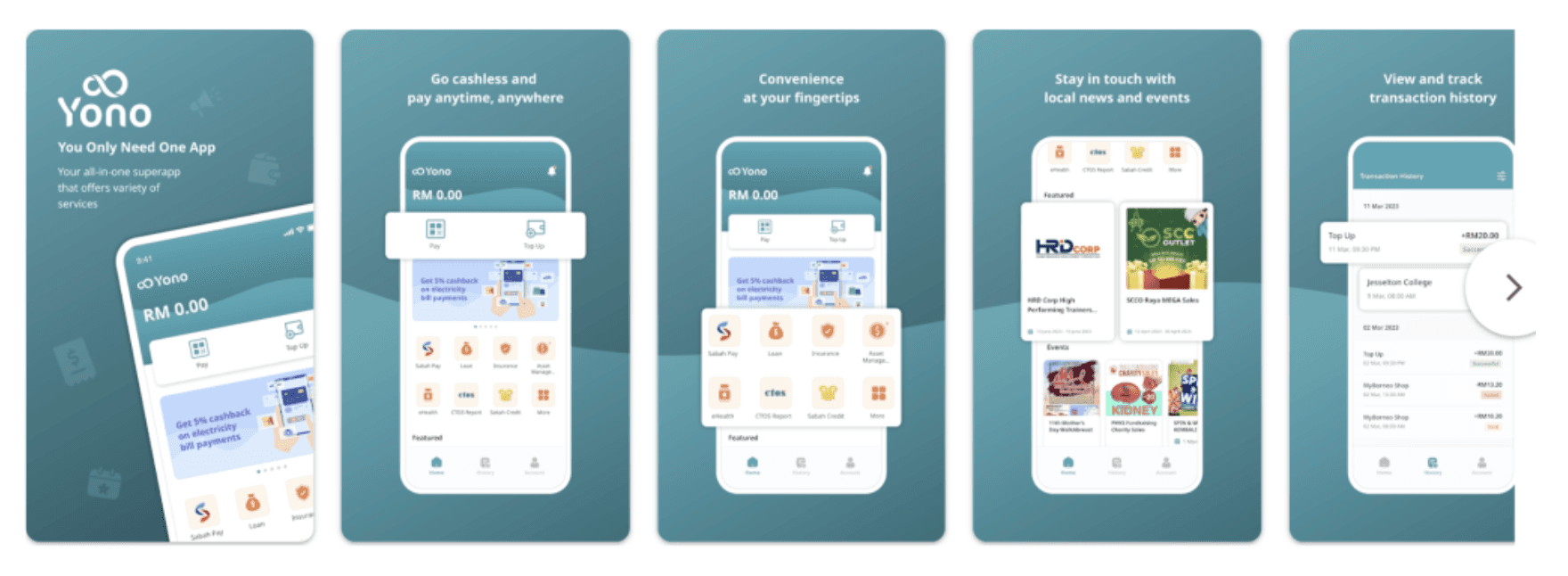

Case Study: Yono

YONO (You Only Need One) is a state-owned financial superapp developed to support citizens and local businesses through a secure, integrated digital wallet and service platform.

This project highlights Agmo’s capability to deliver large-scale, high-governance wallet systems for public-sector and regulated environments.

Key highlights:

YONOPay e-wallet with high wallet limits and deep integration into state-level payment infrastructure.

One-stop access to bill payments, financing, insurance, and financial services within a single application.

Used as an official digital channel for government assistance and grant programmes, enabling citizens to receive and manage aid digitally.

YONO shows how a wallet + superapp architecture can be deployed in high-trust, compliance-heavy environments, supporting financial inclusion, digital disbursements, and citizen-facing platforms, directly relevant to regulated fintech and public-sector-linked use cases in Singapore.

Engagement Models

We support multiple engagement paths depending on your needs:

Custom e-wallet development

Full-tailored build aligned to your product vision.

White-label acceleration

Faster launch using modular wallet components.

Platform integration

Embedding wallet functionality into existing fintech or super-apps.

Let’s Build Your Wallet Platform

If you are exploring a white-label e-wallet, super-app wallet module, or fintech payment platform in Singapore, we are ready to help.

📩 Contact us: ewallet@agmogroup.com

Our team will work with you to assess feasibility, architecture, timelines, and next steps.